What is the current requirement for gambling taxes in Ireland? What is proposed next, and what happens to your bankroll? CasinoAlpha IE answers all these questions in simple terms.

Irish Gambling Taxes Guide

Table of contents

Do Irish Players Need to Pay Taxes on Their Gambling Winnings?

The short answer is no. The Revenue Commissioners, Ireland’s tax and duty authority, only collects taxes from gambling operators.

Gaming

In Irish legislation, gaming means playing something involving skill, chance, or both. Gaming includes Slot sites, Live casinos, and casino games like Roulette or Blackjack, but it excludes sports betting. Regardless of the game, anything that falls into this category involves no fees for the player, and no maximum limits are specified.

The Hakki Decision Summary

- A professional online poker player consulted a professional to see whether he needed to pay taxes for his casino winnings or not, as he was in the middle of a child support trial

- Hakki played at casinos 3-4 days per week, sometimes spending the entire day there

- His lawyer argued that he was not organised enough for his activity to be regarded as a trade or profession

- The Revenue Commissioners approved, and it was determined that the player’s winnings were non-taxable

Many players are confused regarding Irish gamblers’ taxes, and the existence of the Hakki Decision proves it. Despite taking place in the UK, the argument made by Hakki’s lawyer could also be used in a trial involving Irish players’ taxes on gambling. This is because UK and Irish laws and principles regarding gamblers’ taxes are almost identical.

Betting

At the moment, the definition and limits of a bet have to be determined in court from case to case. In terms of taxes, bettors are exempt from Capital Gains Tax (CGT) and Value Added Tax (VAT). The main wager tax currently perceived is valued at 1%. Unlike previously, when it was collected directly from the bettor, the 1% tax is now imposed on betting companies.

Spread betting

A spread bet allows the customer to speculate on stock and share fluctuations without buying any stocks or using a stockbroker.Spread betting is not subject to Income tax, Capital Gains Tax (CGT) or Stamp duty. For now, spread bets should be tax-free for bettors.

Lottery

Lottery winnings are entirely tax-free in Ireland, but

- If you earn income by investing lottery wins, then the named income is taxable

- When the winnings are gifted, a Capital Acquisitions Tax (CAT) may have to be paid

- The same Capital Acquisitions Tax (CAT) may apply to inherited lottery winnings

Offshore Gambling Laws

Offshore gambling providers whose activities fall under Irish gambling laws must request the same licenses from the Revenue Commissioners as Irish operators. Here are the licenses that providers can apply for a Remote bookmaker’s license or a Remote betting intermediary’s license.

What happens to casino service providers?

- The contracts between offshore casino operators and Irish customers shouldn’t be governed by Irish law

- If they aren’t governed by Irish law, there are no Irish players’ taxes on gambling

- Until Irish law includes online casino services, online casinos can’t be registered by the Revenue Commissioners unless they also provide betting services

- For now, Ireland’s best casinos have licences from reliable authorities such as the UKGC or MGA.

Gambling Provider Taxes Explained

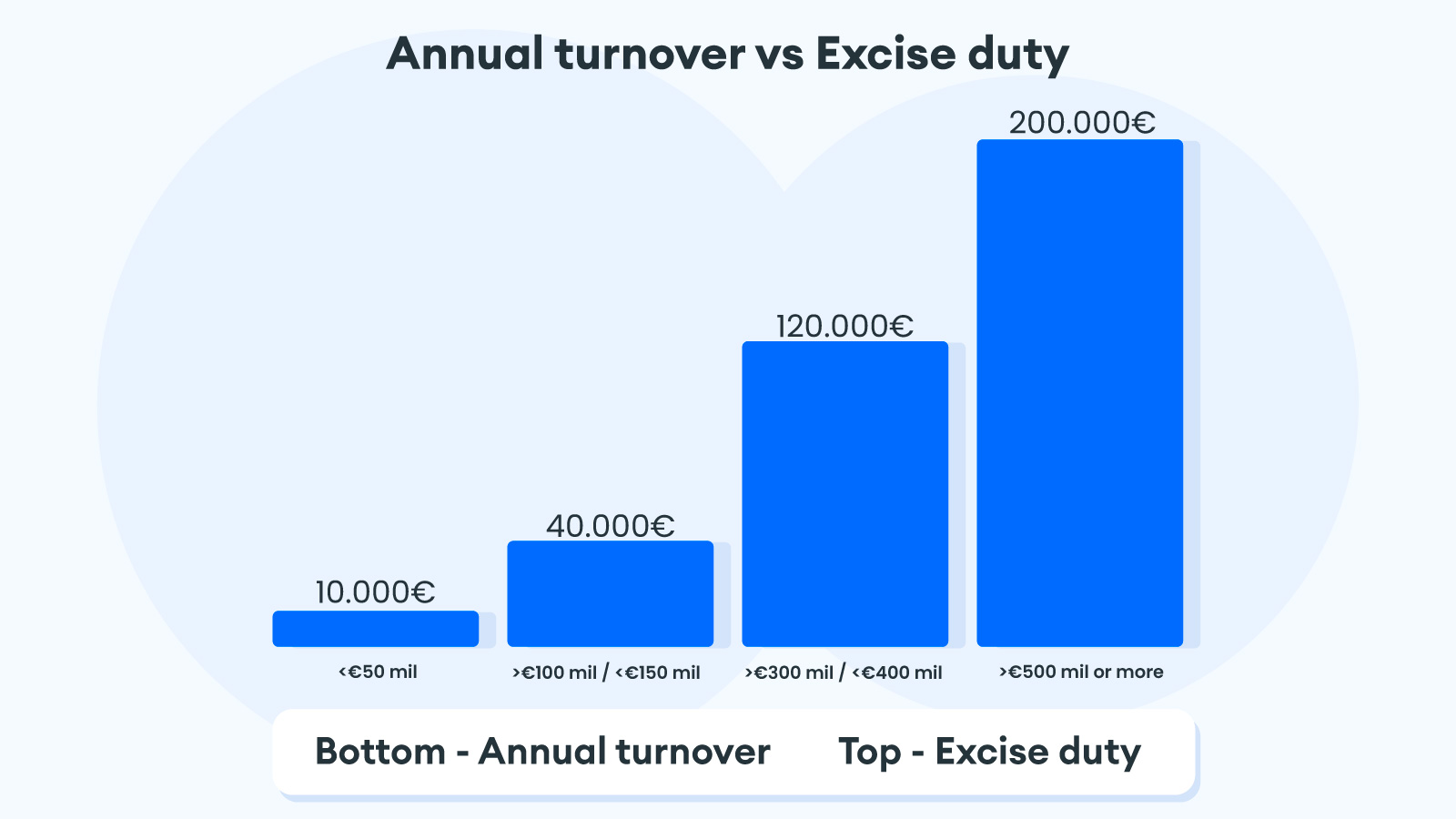

Excise duty

Excise duty is a tax usually imposed in addition to an indirect tax, such as the VAT. The Irish excise duty is legally stipulated for operators that provide bookmaking and gaming, among other services. The Revenue Commissioners can issue the Gaming and Amusement Excise Licence and the Excise Licence based on Turnover, also known as the Remote Bookmaker’s Licence and the Remote Betting Intermediary’s Licence.

The two main licence categories

For the second category, Irish taxes vary depending on the operator’s annual turnover.

Remote Bookmaker’s Licence

Remote Betting Intermediary’s Licence

Can Legal Gaps Affect Your Casino Winnings?

To understand why, let’s look at the Gaming and Lotteries Act (1956). In Section 36, this act regards all gambling and wagering-related contracts as void. This means that no such contract is recognised by Irish law. If they are not valid, the contracts cannot be enforced in court.

What consequences does this regulation have?

If gambling contracts are null, then both players and operators are deprived of receiving gambling debts. To see how players get to win in the first place, read our comprehensive RNG guide.

Are gambling debts enforceable?

No, they’re not. Now that you’ve read the theory, we can discuss how the 1956 regulation works in practice.

The Sporting Index Ltd v O’Shea case:

- John O’Shea placed an online bet on a rugby match, and it turned out to be unsuccessful.

- His account got overdrawn, which resulted in gambling debts.

- The platform sued and obtained two judgments in their favour: one of €118.000 and another of £17.500.

- John O’Shea defended himself using the regulation in Section 36, which states that all gambling and wagering-related contracts are void.

- He also used a European Council regulation. If applied, the reason would be that judgments given in other EU states can’t apply in Ireland if they go against its public policy.

- Sporting Index Ltd argued that the Irish court only had to recognise the previous court order, not the gambling debt itself.

- The Irish court concluded that both were connected, so the previous court order could not be recognised, and the debt could not be enforced.

If you don’t want to get caught up in such a dispute, always turn to reliable Ireland casino reviews before choosing a platform to play on.

How New Tax Regulations Will Impact Players

While the current Irish gambling regulations seem pretty out of date, the near future is promising. An official gambling authority is set to oversee the operators’ activity and assess the possibility of making a complaint regarding the operator. There is also potential for better safety and advertising regulations.

The Irish gambling authority

- It will be the only authority to issue licences and to establish appropriate Irish taxes for licensing.

- It will handle monitoring activities and on-site inspections, along with other types of verifications.

- It must inform the public regarding Irish players’ taxes on gambling, regulations, and services.

- The authority also has to supervise the standard anti-money laundering practices.

Complaints regarding providers are based on:

- The operator’s conduct

- A service, activity, or product supplied by the operator

- The operator’s breach of any regulation imposed by the authority or through the Gambling Regulation Bill

Safety measures

Licence holders are not allowed to extend any loan or credit to a player, and ATMs cannot be placed on the premises of a gambling facility. Operators must raise awareness of how to stop gambling addiction using responsible gambling tools. Also, all operators must impose limits that ensure player protection, such as spending limits.

Understanding Gambling Fee Structures

Along with the publication of the Gambling Regulation Bill, fees and taxes may change. When establishing licence fees, the new authority will consider:

- The types of gambling provided by the operator;

- The operator’s turnover;

- The size of the operations;

- Any other criteria the authority regards as relevant.

Since there aren’t many criteria to check if you want to see whether a casino platform is safe for Irish players, here’s a complete list of online casinos in Ireland, which we’ve already verified.

References

Meet Our Experts

Author

Elena Buzincu

Senior Author & Editor

Recommended Articles

New Gambling Bill in Ireland

The new Irish gambling bill creates the most significant player protections in Europe, with our analysis revealing stricter measures than even the UK’s gambling reforms. What many don’t realise is that operators will now face penalties of up to €20 million or 10% of turnover for violations, creating real accountability. These sweeping changes will transform everything from bonus offerings to advertising practices across all gambling verticals.

By Anca Iamandi

Can a casino refuse to pay out?

A shocking truth is that around 12% of online casino complaints involve refused payouts each year in Ireland alone. According to our Chief Editor and CEO, Tudor Turiceanu, “Many players don’t realize their exact rights until it’s too late.” By understanding your legal position clearly now, you can protect your winnings effectively whenever a casino refuses to pay.

By Anca Iamandi

Casino Debit and Credit Card Fraud

Casino debit and credit card fraud has increased by 34% since the pandemic shifted more gambling activity online. What many players don’t realize is that standard bank fraud protections often apply differently to gambling transactions, leaving you more vulnerable than you might expect. This comprehensive legal overview will help you understand exactly how to secure your payment information, recognize warning signs of potential fraud, and take proper legal action if your card details are compromised.

By Elena Buzincu

Which Slots Winning Method Pays out the Best?

Slots winning methods range from the mathematical to the mystical, with an estimated 65% of regular players following some form of personal system. “Most players desperately want to believe they can outsmart a machine specifically designed to generate profits through mathematical certainty,” notes our gaming expert Adina Minculescu. Through this analysis, you’ll gain clarity on which strategic approaches align with actual slot mechanics and which popular methods are expensive exercises in wishful thinking.

By Anca Iamandi

Pay attention to the casino bonus terms

A €100 casino bonus sounds great until you find the 45x wagering and 5-day expiry buried in the terms. After testing dozens of offers, I’ve seen how quickly players lose winnings due to unclear rules. This blog decodes the fine print so you’ll know what’s fair, what’s risky, and how to use bonus money wisely.

By Adela Mariuta